Welcome to the topic “Unlocking Value with Sale-Leaseback Transactions“

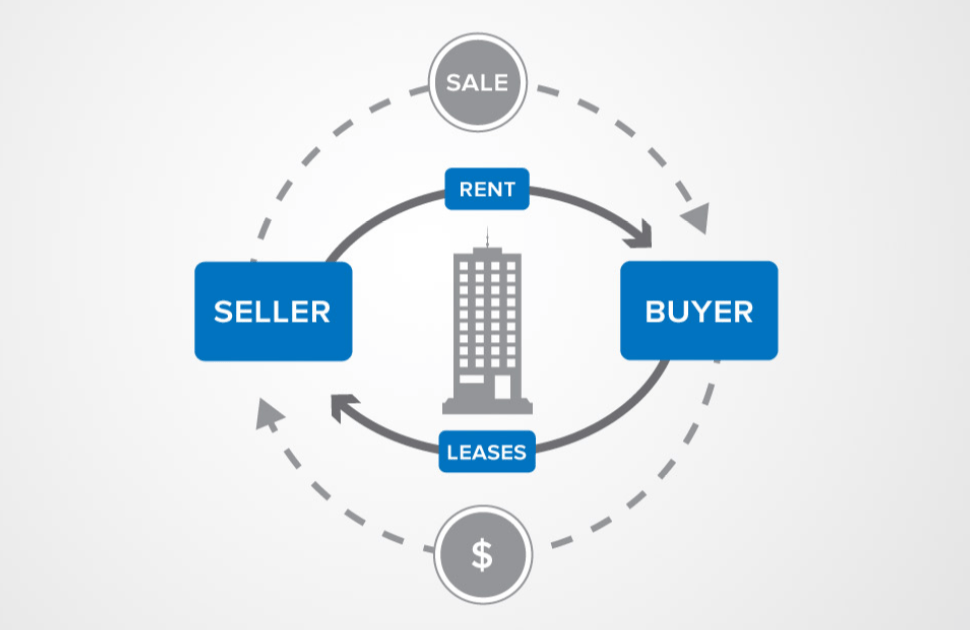

Business owners across the country are raising capital for their companies by unlocking the power of sale-leasebacks. Sale-leasebacks are a type of financial transaction where a business sells its owned real estate property to an investor or buyer, and then leases back the same property from the new owner under a long-term lease agreement.

By executing a sale-leaseback transaction, business owners are able to free up the capital from their real estate assets, while still operating in their existing property.

Sale-leasebacks make the most sense when businesses want to raise capital for internal infrastructure, enhance financial flexibility, or allocate more resources towards core business activities.

By selling a property and leasing it back from the buyer, businesses give their balance sheets a huge boost while improving their operational flexibility, cash flow reserves, and market position.

Top 3 Benefits of Sale-Leasebacks

Sale-leasebacks can be done in a variety of ways. Just like in traditional real estate transactions, every deal is different. That’s what makes the sale-leaseback so powerful and attractive to business owners. The terms of a sale-leaseback can be negotiated the way both parties desire, and it’s typically a win-win situation for both buyer and seller.

However, it’s important to note that as the terms of the deal vary, so do the benefits. Therefore, every business owner looking to execute a sale-leaseback should ensure that they walk away from the deal with these top three benefits.

1. Liquidity

By accessing capital through sale-leasebacks, business owners are able to reinvest in their core operations, pay down debt, or pursue new opportunities such as investing in technological advancements, expanding product lines, enhancing marketing efforts, or acquiring competitors.

Additionally, companies can use the liquidity to improve their competitive position by investing in sustainability initiatives, enhancing employee benefits, and funding research and development projects.

By using the freed capital to drive innovation and expansion, businesses can better respond to market demands and grow. To maximize the liquidity benefit of a sale-leaseback, business owners should negotiate favorable lease terms that offer flexibility and financial stability.

This includes securing long-term leases with predictable costs and options for renewal. Doing this will give business owners more financial agility, allowing them to pivot quickly in response to changing market conditions.

2. Operational Control

Sale-leaseback transactions provide businesses with the unique advantage of maintaining operational control over their properties – even after selling them. This stability in operations allows companies to maintain productivity levels, focus on core business activities, and uphold service standards with minimal (if any) interruption. By retaining control of the property, businesses also avoid the costs and logistical headaches associated with relocation; particularly during times of growth or market volatility.

To maximize the advantages of operational control in sale-leaseback deals, businesses should prioritize negotiating lease terms that support their operational needs. This may include continued access to on-site equipment, facilities, management systems, or anything else that would impact the productivity of the organization.

3. Tax Advantages

In sale-leaseback transactions, businesses get tax benefits through deductible lease payments. By deducting lease payments and other relatable expenses, companies can potentially lower their tax liability. Companies can also avoid depreciation costs associated with property ownership, further improving their balance sheets.

These tax advantages make sale-leaseback transactions an attractive financial strategy for companies looking to optimize their cash flow and strengthen their financial position.

To fully leverage these tax advantages, businesses should engage with tax professionals or financial advisors who specialize in real estate transactions. These professionals can provide tailored guidance on structuring the sale-leaseback lease agreements to maximize tax benefits while ensuring regulatory compliance.

Executing a Sale Leaseback Transaction

Executing a sale-leaseback transaction involves several key steps to ensure a smooth and beneficial process for both the seller and the buyer. Here’s a general outline to the steps involved in performing a sale-leaseback transaction:

Assess the Property and Financial Needs

The first step in executing a sale-leaseback transaction is to thoroughly assess the property and your company’s financial needs. Objectively evaluate the property’s market value through a professional appraisal to ensure an accurate understanding of its worth.

You should also identify the financial objectives driving the sale-leaseback decision, whether it’s unlocking capital for business expansion, reducing existing debt, or enhancing liquidity. Understanding your goals for the transaction is crucial as it will influence the negotiation process and the terms of the lease agreement.

Select a Qualified Buyer

Identifying and selecting a qualified buyer is essential for a successful sale-leaseback transaction. Potential buyers typically include real estate investors or investment firms with a strong interest in purchasing commercial properties for leasing purposes.

It’s important to consider the buyer’s financial stability, reputation, and experience in similar transactions. The right buyer should not only offer a fair purchase price, but also favorable lease terms that align with your company’s operational needs.

Negotiate Terms

Once a potential buyer is identified, the negotiation process begins. Both parties must agree on the sale price, ensuring it reflects the property’s fair market value.

Next, detailed lease terms need to be negotiated, covering aspects such as lease duration, rental rate, renewal options, and maintenance responsibilities. It’s vital to ensure these terms support your company’s financial and operational goals, providing stability and predictability over the lease period.

Conduct Due Diligence

Due diligence is a critical phase where both parties thoroughly investigate each other and the property. The seller should verify the buyer’s financial health and past performance in similar transactions to ensure they are reliable.

The buyer should conduct due diligence on the property, which may include physical inspections, title searches, and reviewing financial statements.

This process ensures transparency for both parties and addresses any potential issues before finalizing the transaction.

Draft and Review Legal Documents

With terms agreed upon and due diligence completed, the next step involves drafting and reviewing the necessary legal documents for the deal.

This includes both the sale agreement and the lease agreement.

A good real estate broker will know what to look for and what to expect with both sale and lease agreements. Engaging an experienced attorney is also crucial to ensure all terms and conditions are clearly outlined and legally binding. This step helps prevent future disputes and ensures both parties fully understand their obligations and rights.

Finalize the Transaction

Once all legal documents are prepared and reviewed, the transaction moves towards closing. At this stage, the property title is transferred to the buyer, and the seller receives the agreed-upon sale proceeds.

The lease agreement is then signed, officially transitioning the company from property owner to tenant.

This phase marks the formal completion of the sale-leaseback transaction.

Post-Transaction Management

After finalizing the transaction, ongoing management of the lease is essential.

Your company must adhere to the lease obligations, which include timely rental payments and property maintenance as specified in the lease agreement.

Additionally, it is important to monitor the financial impact of the transaction to ensure it meets the strategic goals set out at the beginning of the process.

Regular reviews can help assess the benefits and address any issues that may arise, ensuring the long-term success of the sale-leaseback arrangement.

Real-World Examples of Successful Sale-Leasebacks

Several high-profile companies have successfully leveraged sale-leaseback transactions following the outline above. These companies were able to unlock value from their real estate assets to reinvest in their operations, proving the success and value of the transaction.

Amazon: The e-commerce giant has used sale-leasebacks to free up capital for expanding its logistics network. By selling and leasing back distribution centers, Amazon has been able to reinvest in its rapid growth strategy.

FedEx: FedEx has engaged in sale-leaseback transactions to optimize its real estate portfolio. These deals have provided the company with the flexibility to scale its operations while maintaining control over critical logistics hubs. This approach has enabled FedEx to enhance operational efficiency and adapt to market demands.

CVS Health: CVS Health has executed sale-leasebacks for its retail locations, allowing the company to raise capital for strategic initiatives such as expanding healthcare services and investing in digital health technologies. This strategy has supported CVS Health’s long-term growth and innovation goals.

The sale-leaseback model presents a great opportunity for commercial property owners to unlock capital, enhance liquidity, and maintain operational control within their business. In the current market environment, with increased investor interest and strong pricing factors, now is the ideal time to consider this strategic move.

Partnering with TAG

At TAG, we specialize in helping businesses navigate the complexities of sale-leaseback transactions. Our expert team can provide comprehensive guidance to ensure you maximize the benefits of this strategic move. Whether you’re looking to unlock capital for growth, improve your balance sheet, or take advantage of the strong market conditions, we are here to support you every step of the way.

Contact us today to learn how a sale-leaseback can benefit your business and to explore the opportunities available in the current market. Let’s work together to unlock the full potential of your real estate assets.

Also read: Positioning to Sell Your Industrial Property

TAGS